My wife and I bought our new 3-family home in Brooklyn in May of 2013. It was a long 9-month purchase process culminated by a day of excitement and lifetime of cash flow. But she and I don’t call ourselves home owners…yet. For now, we’re just home buyers. We won’t officially be home owners until the mortgage is fully paid off.

It sounds like semantics, but language is important. Prior to buying our home, we used to watch Property Hunters on HGTV and the moment someone gets their keys, they say “Congratulations! You’re a new home owner.” Siiiikkkee! The bank owns your home until you pay them off.

I believe that you should wait on buying a home too—especially when it comes to buying a single family home. Here is why we waited a few extra years, saved up some more money, bypassed buying a single family home first, and bought an income property instead.

1. The American Dream Is Backwards.

The American Dream tells you to buy a nice single family home with a white picket fence first, work really hard to pay it off, and then once you have some breathing room financially, consider buying an income property or two.

We reversed it. By buying an income property first, we actually have more freedom right now than if we were to buy a single family home first, because our tenants help us pay the mortgage. With their help, our mortgage on a bigger, more expensive home, is less than it would be on a single family home.

For right now, we are basically living in our piggy bank and other people are contributing to our piggy bank each month. Now, if we decide to buy a single family home, we know that our income property will pay for itself and we’ve established an asset.

2. A 30 Year Mortgage Can Kill Your Dreams.

The psychology of home ownership is twisted. You get keys to something you don’t really own yet in its entirety. Your family, friends, and realtor call you a “home owner,” and you start saying things like “my house.” But in reality, it’s not yours…yet.

We immediately move all of our stuff inside and start designing our lives around this specific location. Your job is nearby. You make friends in the neighborhood. You put your kids in local schools. We start rooting our lives in quick sand all based on the assumption that our income will rise and so will the value of our home.

At this moment, a lot of people feel trapped in jobs they hate because they have to pay the mortgage. It’s not like a cell phone bill or student loans where you can call and defer a payment or two if something crazy and unexpected happens. Now this individual can’t take the risks they were able to when they were renting and had a 1-year lease. Any dip in income for the month would put financial and emotional stress on them.

Unless they have a side hustle that brings in extra income, they have to wait patiently on the corporate ladder for a raise or promotion to get some breathing room financially because housing expenses usually take up more than half of people’s paycheck. When you’re a home buyer, it more than just the mortgage—you also have to consider taxes, insurance, and maintenance.

3. The Key To Financial Freedom Is Cash Flow.

We mistakenly call our paychecks our “income,” when in fact, income is revenues minus expenses. Your income is not your paycheck. Your income is what is left over at the end of the month after you get your check and pay all of your bills. This number makes up your cash flow. Because a lot of people allow their cost of living to rise with their income, their cash flow is still low. If you make $100,000 per year but you spend $95,000, you have very little cash flow.

A single family home takes money out of your pocket for 30 years in the form of mortgage, taxes, and fixes. It hurts your cash flow.

But if you saved up for a few more years to buy a multifamily home instead of a single family home, now you have renters. Depending on how many units you have, renters can cover you mortgage and taxes or at least help so that the entire mortgage isn’t dependent on you and your family.

4. The Appreciation Of Your Home Isn’t Guaranteed.

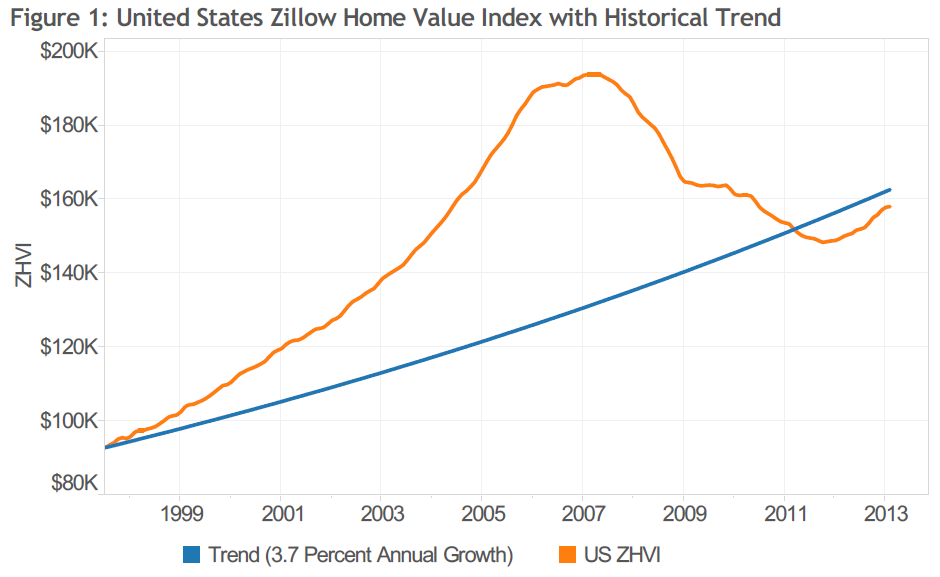

We’re often told that real estate always appreciates. That’s not true. What goes up must come down. Real estate fluctuates just like anything else. You can see the trend since 1997 in the chart below. The average growth rate over the past 15 years has been 3.7% annually. That’s not a lot.

If I gave you 100 pennies and asked you “Can you turn these 100 pennies into 105 pennies 365 days from now?” you would likely say “Yes! Of course I can.” Well that’s a 5% growth rate.

Plus you can also see the dip between 2007 and 2012. Because of this dip a lot of people’s homes are under water meaning that every month they are paying more than the home is actually worth.

When I buy an asset, I oftentimes disregard the potential appreciation such as a property’s worth going from $300K to $400K over 5 years. Why? Because appreciation is outside of my control. I can do things to renovate my home, but in large par,t appreciation depends on external factors such as my neighbors and the upkeep of their homes, the schools, the safety, local businesses, and the economy as a whole.

Your home will only be profitable to sell IF (that’s a BIG IF) the property appreciates because of market conditions which are out of your control. So unless your first home is your last home, it’s likely that you’re going to try to sell it before the 30-year mortgage is paid and there is no guarantee that it will have appreciated. Instead, I focus on the cashflow which is how much it will bring in each month—for instance $500 extra dollars per month. Once the mortgage is paid, that $500 can jump to $3,000 because now all of the rental income goes to me instead of the bank.

Conclusion

Don’t trap yourself in a job, city, or home that you aren’t sure you want to be in yet. If you wait a few more years and are able to save a little bit more to buy an income property such as a duplex, 3-family, or 4-family home instead, you will experience more financial freedom in the short-run and the long-run.

Once you move out of your unit, you will be able to find the single family home of your dreams and you will have an extra stream of income coming in from your renters until you sell the property or you die.

I’m new to this and still learning, but I’m sharing as I go. I hope this helps for now. Do your own research and calculations. One of the best books that opened my eyes to this early on was Rich Dad, Poor Dad by Robert Kiyosaki.

Hustle smarter & D.R.E.A.M. awake!

P.S. Here is the best Rent vs. Own calculator I’ve seen online. Try it out.